Explore payday loans eLoanWarehouse, understanding benefits and risks involved in short-term borrowing.

Introduction to Payday Loans eLoanWarehouse

Hey there! If you’ve ever observed yourself stuck between paychecks and in want of quick coins, payday loans would possibly have crossed your mind. These short-term loans supplied by way of locations like eLoanWarehouse may be a lifesaver whilst you’re in a pinch. Before you bounce in, though, it is vital to recognize each the perks and pitfalls. In this weblog, we’ll wreck down the whole lot you want to realize approximately payday loans, how eLoanWarehouse suits into the photograph, and some smart financial recommendations to navigate this borrowing alternative. So, snatch a cup of coffee, and permit’s dive in!

Understanding Payday Loans

Definition and Purpose

Payday loans are a form of short-term borrowing where you can get hold of instantaneous cash in alternate in your destiny paycheck. Most often, people keep in mind payday loans when they are a bit strapped for cash and need to cowl emergencies or sudden costs. These loans aren’t supposed to tide you over for long periods. Instead, they may be devised to tackle urgent financial desires till your subsequent payday arrives.

The number one motive of payday loans is easy: to offer a short injection of coins when you’re in a pinch. They’re now not designed for large quantities but normally variety from $100 to $1,500. Due to the short repayment timeline, they arrive with better hobby fees than conventional loans, making it vital to understand their mechanics before diving in.

Common Uses and Benefits

So, whilst do humans commonly locate payday loans useful? There are pretty a few eventualities! For starters:

- Unexpected Medical Expenses: Sometimes, scientific emergencies pop up out of nowhere. In such situations, payday loans can provide the on the spot funds needed to deal with those pressing healthcare needs.

- Home or Car Repairs: From a surprising leaky roof to a vehicle that gained’t begin, payday loans can assist cover repair fees that you hadn’t predicted.

- Avoiding Bounced Checks: Let’s face it; bounced assessments can result in hefty financial institution overdraft prices. A payday mortgage may offer a buffer for the duration of tight economic months.

The beauty of payday loans lies of their accessibility and velocity. They are available to most humans, even people with much less-than-ideal credit scores. Plus, the utility system is often sincere, because of this you may often acquire finances quick—from time to time within the same day.

Overview of eLoanWarehouse

eLoanWarehouse has set up itself as a relied on participant within the payday loan marketplace. Their journey started out with a simple assignment: to make quick-term borrowing uncomplicated, secure, and handy to each person in want. With a focus on transparency and consumer care, eLoanWarehouse puts its customers first, ensuring that borrowing is not only smooth however also informed.

They’re famous for his or her person-pleasant on-line platform, which presents borrowers with clear mortgage phrases and conditions. This has positioned eLoanWarehouse as a reliable vacation spot for those in search of payday loans with warranty and simplicity. Their dedication to customer pride sets them aside within the bustling world of short-time period lending.

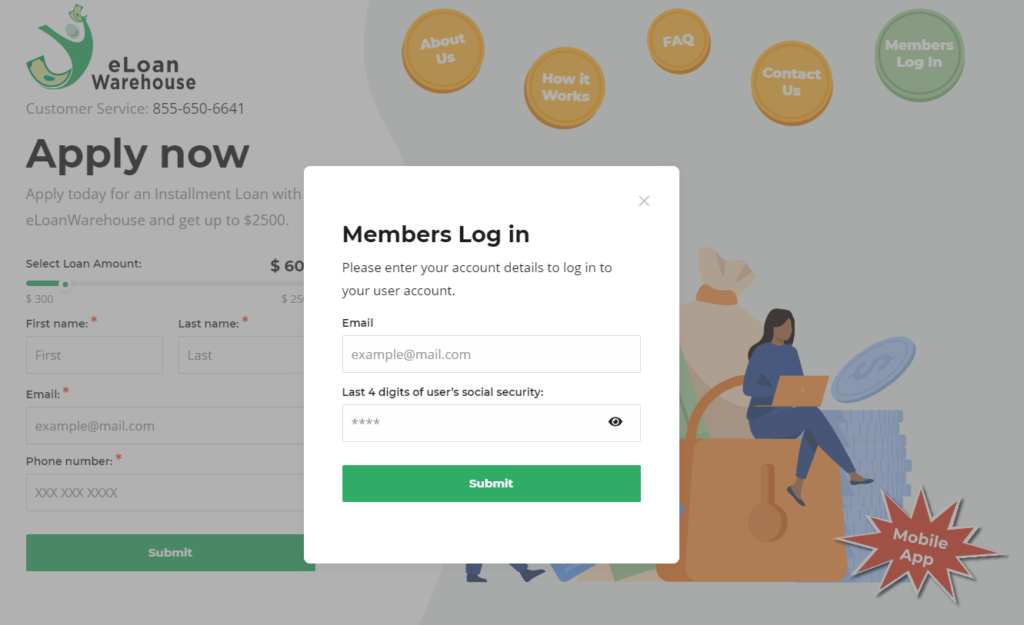

How eLoanWarehouse Works

The eLoanWarehouse technique is as sincere because it receives—due to the fact no one wishes more problem in a monetary pinch! Here’s a step-by-step study how it commonly works:

- Application: Visit their internet site and fill out a easy on-line application. You’ll want to offer a few fundamental records about yourself, your employment, and your financial institution details.

- Approval: The approval technique is typically fast. ELoanWarehouse assesses your software and creditworthiness, quick giving you a nod in case you meet their criteria.

- Receive Funds: Once authorized, finances are commonly deposited into your financial institution account promptly. Many customers see the deposit as quickly as the following commercial enterprise day.

- Repayment: The mortgage is usually due on your next payday. ELoanWarehouse will mechanically debit the amount from your financial institution account on the agreed date, making repayment seamless and fuss-free.

how eLoanWarehouse work as instalment payment

| Loan Amount | Term | Number of Payments | Payment Frequency | Interest Rate | Early Payoff |

|---|---|---|---|---|---|

| Up to $1,000 | 9 months | 18 payments | Bi-weekly | Varies | No penalty |

| Up to $1,750 | 9 months | 18 payments | Bi-weekly | Varies | No penalty |

| Up to $2,000 | 9 months | 18 payments | Bi-weekly | Varies | No penalty |

| Up to $3,000 | 12 months | 24 payments | Bi-weekly | Varies | No penalty |

- Loan Amount: The maximum amount you can borrow.

- Term: The duration over which the loan is to be repaid.

- Number of Payments: Total number of payments to be made.

- Payment Frequency: How often payments are made (e.g., bi-weekly).

- Interest Rate: The rate of interest applied to the loan (varies based on the loan amount and term).

- Early Payoff: Indicates if there is a penalty for paying off the loan early (eLoanWarehouse does not charge a penalty for early payoff).

Benefits of Using eLoanWarehouse

Turning to eLoanWarehouse on your payday mortgage wishes comes with its personal set of advantages:

- Fast Approval and Disbursal: Time is of the essence in relation to quick-time period economic crunches. ELoanWarehouse ensures a brief approval system and rapid fund disbursement.

- Transparency: They delight themselves on having no hidden fees. Clear conversation around interest costs and costs means you already know precisely what you’re moving into.

- User-Friendly Experience: Their on line platform is designed to be intuitive, allowing even the ones new to the virtual world to use for loans with no trouble.

- Flexible Loan Amounts: Whether you need a small quantity or something toward your whole paycheck, eLoanWarehouse gives flexibility to fulfill a number financial wishes.

- Supportive Customer Service: Got a query or going through an issue? Their customer support team is only a call or click away, equipped to assist you anytime.

In brief, whether or not you are going through an unforeseen expense or looking to avoid an overdraft, payday loans via eLoanWarehouse ought to offer a feasible answer. Just take into account, even as they are able to clear up brief-time period financial hiccups, it is important to borrow responsibly and bear in mind of the compensation terms to save you any destiny financial pressure.

Risks and Considerations of Payday Loans

Payday loans, conveniently available via structures like eLoanWarehouse, can be a short fix for instant economic desires. However, it is crucial to be knowledgeable approximately the potential risks lurking in the back of their comfort. Let’s dive into some vast considerations you have to maintain in thoughts before committing to a payday mortgage.

High-Interest Rates

One of the most remarkable dangers associated with payday loans is their high-hobby fees. These loans frequently come with annual percentage rates (APRs) that are drastically higher than those for conventional loans or credit playing cards. This means you may turn out to be repaying appreciably greater than what you first of all borrowed, that’s some thing to very well recall. For example, a small loan of some hundred greenbacks can morph right into a hefty reimbursement responsibility whilst hobby is factored in. It’s critical to calculate the overall value and suppose hard if the convenience outweighs the economic burden.

Potential Debt Cycle

Another vital attention is the potential for falling right into a debt cycle. Due to excessive-interest costs and short repayment periods, borrowers would possibly find themselves not able to pay lower back the mortgage on time. This state of affairs regularly leads to removing some other loan to cowl the preceding one, creating a in no way-finishing cycle of debt. If you’re the usage of a payday loan to cowl normal costs due to the fact ends do not meet continuously, it is probably time to revisit your average economic plan. Finding a sustainable financial solution will shield you from this type of debt lure.

Regulatory Factors

The policies surrounding payday loans can range considerably from one state to any other. Some places have strict guidelines that cap hobby costs and restriction prices, even as others would possibly have greater lenient legal guidelines that allow creditors to rate better prices. Understanding the particular rules to your place is crucial to avoid sudden prices and make certain that you’re included via neighborhood consumer safety legal guidelines. Always are searching for particular statistics about the phrases and situations related to the payday mortgage you’re considering, as these excellent prints carry important information which can impact your economic fitness.

Tips for Utilizing Payday Loans Responsibly

Understanding the dangers associated with payday loans is the first step. Next, permit’s explore some tips for using these financial equipment responsibly. This technique will help you are making knowledgeable decisions whilst assembly your short-time period monetary desires with out jeopardizing your economic destiny.

Evaluating Your Financial Situation

Before applying for a payday mortgage, it is crucial to take an sincere examine your economic situation. Ask your self if this mortgage is necessary or if you could deal with this price via different way. Do you have a fallback plan for repayment, and have you budgeted for any costs and interest? If you rely on payday loans often, it might be well worth addressing the underlying causes of financial shortfalls. Consider alternative avenues for help, like network sources or price range restructuring, which would possibly provide longer-term advantages with out the high expenses of payday loans.

Comparing Different Lenders

Not all payday creditors are created equal. Take the time to compare exclusive lenders, that specialize in their terms, hobby costs, and expenses. Choose a good lender known for transparency and truthful practices, like eLoanWarehouse, which is understood for providing clear phrases. Online reviews and economic boards can offer insights into client studies and help you identify truthful creditors. Be wary of lenders that do not absolutely disclose all expenses beforehand of time or stress you into making on the spot choices.

- Reputation: Look for comments from different borrowers to gauge reliability.

- Transparency: Favor creditors who’re open approximately all capability costs and situations.

- Customer Service: A useful and responsive customer service group can be a sign of a lender that values its clients.

Planning for Repayment

A essential a part of borrowing any sort of mortgage is making plans for its reimbursement. When you’re considering a payday mortgage, map out how you may cowl the compensation on or before the due date. Late bills frequently incur additional prices, and being not able to pay returned on time can damage your credit score or lead to greater severe consequences. Establishing an in depth plan for a way you’ll accumulate the budget can assist save you unpleasant surprises when the mortgage comes due. Also, putting aside a portion of your earnings particularly for mortgage compensation can decrease pressure and ability financial stress.

In conclusion, whilst payday loans can be beneficial in pressing conditions, they arrive with risks that should not be taken lightly. By know-how excessive-hobby prices, avoiding a debt cycle, and retaining a watch on regulatory factors, you could arm your self with the expertise had to make informed decisions. Furthermore, by means of evaluating your economic situation, comparing creditors, and thoroughly making plans your compensation method, you may navigate the arena of payday loans responsibly and preserve your economic health intact.

Conclusion

In conclusion, even as payday loans eLoanWarehouse can provide an immediate economic reprieve, it’s crucial to approach them with a level head. These brief-term loans may be useful in emergencies but can result in a cycle of debt if now not controlled wisely. Always:

- Evaluate your financial state of affairs cautiously.

- Read the phrases and conditions very well.

- Ensure you have got a realistic compensation plan.

Consider all your alternatives and equip your self with the proper financial guidelines and mortgage advice to make the first-rate decision for your instances. By doing so, you could take manage of your budget with self assurance and avoid ability pitfalls. Remember, borrowing accurately is the key to retaining your financial health.